The story behind Trump’s wall with Mexico, explained

Of the many, many, many Trump-related headlines since his inauguration on the 20th of January, one of the most controversial is the plan to build a wall along the Mexican border, charge Mexico the bill, and tax imports to cover costs until they pay up.

Let's start at the beginning.

Why is Trump so determined to lower immigration from Mexico?

Two words: ‘America First’. The logic goes: American companies should employ American people, and right now, it seems like there aren’t enough jobs to go round. That’s partly because American companies are moving to China – something Trump is planning on fighting in a separate battle – but it’s also because immigrants are doing jobs that Americans could be doing. The theory is that every immigrant who takes a job leaves one less for an American citizen.

And they’re not just taking jobs – they’re taking less money for their work, too. The more people compete for a position, the more the employer can reduce the rate they’re offering, in the knowledge that people face the choice of accepting their lower rate, or remaining unemployed. Because immigrants often seem more willing to accept lower wages than Americans, Trump and his supporters feel they’re deliberately undermining Americans’ right to a decent wage – what’s known as ‘suppressing’ wage levels.

So, would reducing immigration really make things better for Americans?

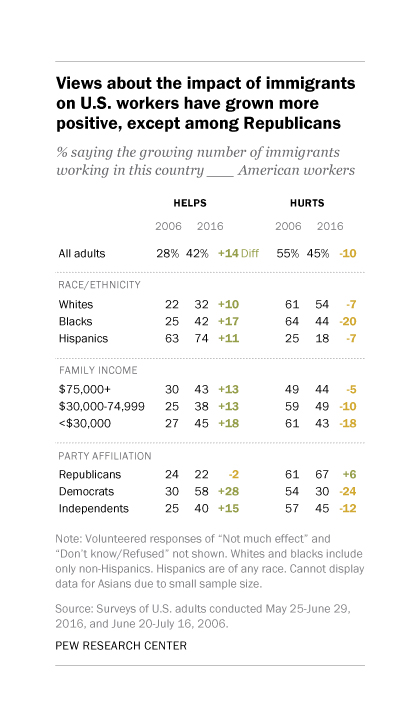

This is one of the thorniest issues in politics at the moment. Public opinion in the US is pretty evenly split - 42% of Americans think having immigrants helps workers, a 14% increase from 2006, and 45% think it hurts workers, a 10% decrease from 2006. So over the past ten years, there’s been a noticeable change in attitudes towards feeling like immigration is a good thing for the economy. But among Republicans, who hold the majority across American government, opinion has changed in the opposite direction - 54% of them feel immigration hurts workers.

Economists have found that it basically depends on where you live. The most comprehensive study done on this to date found that in general, the immigrants coming to the US in recent decades have actually been beneficial to the economy and haven’t had much impact on the wages or employment of those born in America.

The thing is, these benefits aren't always felt at the local level. Particularly in small towns with low government budgets and not much local business, population growth of any form can put pressure on local economies if it's not managed properly. So although studies across the board demonstrate that countries do better as a whole as a result of immigration, it’s a verdict that doesn’t really resonate with everyone’s day to day.

Even among those Americans keen on reducing immigration, the majority aren’t convinced a wall is the way to do it. 90% of Republicans and 67% of Democrats want stricter policies to stop immigrants overstaying their visas, so there’s a recognised need to tackle immigration across both parties. But only 39% of people see building the wall as ‘important’ in achieving that goal.

What would a wall even cost?

One thing to get straight: There actually already is a wall – or more specifically, a fence – on the Mexican border. The border is about 1,900 miles long and basically crosses a mountain range - not ideal for building a wall.

The existing 650 mile fence along the border cost over $7 billion, but even with a price tag like that, it’s not anywhere near the quality Trump’s after. He wants it ‘impenetrable, physical, tall, powerful, beautiful’ – which doesn’t come cheap. It’s not just the 339 million cubic feet of concrete – a lot of the land is privately owned, so would need to be bought, and crossing mountains which would be a nightmare to build on. Trump estimates the wall would cost $10-12 billion, but others reckon it will be more in the region of $25 billion.

What's all this about paying for it with an 'import tax'?

When Trump said, Mexico will pay, that confused a lot of people - including Mexico, who said no we won’t – mainly because they don’t want to, but also because they can’t afford it. Trump’s solution to the latter problem is for the US to pay for it in the interim, by putting a 20% tax on imports from Mexico.

“If you tax that $50 billion at 20 percent of imports… we can do $10 billion a year and easily pay for the wall ”

Sean Spicer - White House Press Secretary

Translation: If the Mexican government can’t, or won’t, pay, an import tax will make Mexican companies foot the bill instead.

So who will actually foot the bill?

If stuff imported from Mexico is going to cost 20% more to buy in America, it’s likely that the cost will just be passed on to US companies buying Mexican products, who can just bump up their prices – meaning the American consumer ends up paying the difference. As in, if a US car manufacturer is buying Mexican car parts at 20% import tax, the Mexicans can just increase the price, affecting the American car consumer, who has no choice but to accept it.

What could happen next is known as ‘ ’ – this means there could be a general increase in prices in the US. If wages don’t increase at the same pace as prices, US citizens would find they can’t buy as much with their salaries as they used to.

US citizens buy loads of goods which are at least partly from Mexico - not just car parts but tomatoes, avocados, fridges, and yes, tequila, are all major imports to the US from Mexico, so would be likely to increase in price. Americans with a low income would feel the pinch the most. On the other hand, the tax would be good news for some US companies which compete with Mexican firms - their products would be relatively cheaper if Mexican imports become more expensive.

Let’s say the import tax worked perfectly. Would it make enough money to fund the wall?

According to government trade data, the US imported $295 billion worth of products from Mexico in 2015. So if the amount of trade stays the same, the tax would make $59 billion in a year - plenty to cover the costs.

The problem is – and this part gets jargon-y – it’s unclear whether the plan is to tax everything that crosses the border, or just the stuff that contributes towards the difference between money made from imports from and exports to Mexico (the ‘trade deficit’). You’d think Trump’s administration would have made that clear… sadly not.

We know two things: one, that the tax will come in "a form, perhaps a complicated form" – and two, that it is only one of a "buffet of options". Who knows which plate they will ultimately serve up.