Are we right to be so angry about the Paradise Papers?

Remember that time Apple wasn't paying enough tax? What about the time Amazon wasn't paying enough tax? Or there was that time with the footballers, that time with the members of Take That...

This time around we’ve got the Paradise Papers, a new bout of leaks which reveal the names of (very) rich people and (very) rich companies around the world using offshore businesses to squirrel away money in tax havens.

A lot of what’s going on could be completely legal, and a lot of the people named didn’t even know their money was there (e.g. Bono, and the Queen). But that doesn’t necessarily mean people are okay with it. A 2013 YouGov poll found that most people in the UK think legal tax avoidance is just as wrong as illegal tax evasion.

Two weeks after the revelations, the UK parliament called an emergency two hour debate on the Paradise Papers, in which they all pretty much agreed that something had to be done.

If it’s legal, why do we care so much?

The interesting thing about this story is that it’s being treated as a scandal, but if you’re just going by the book, a lot of these people aren't doing anything wrong.

The question is whether we think the law is right – which is a question of what we think is fair, and how far we think we should go to incentivise people to do business in our countries.

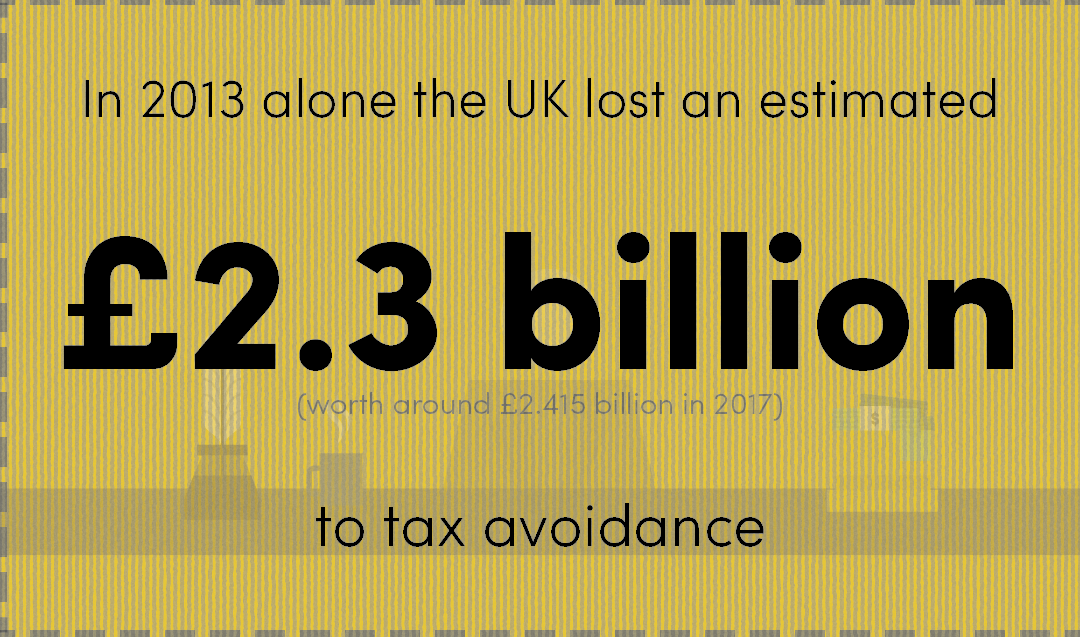

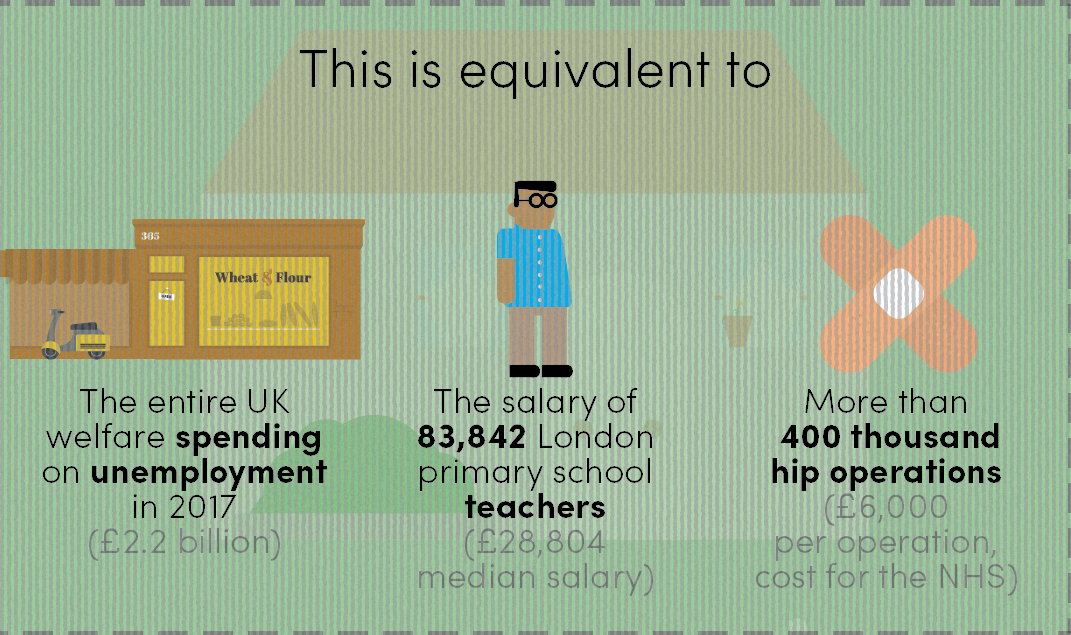

It's the fairness thing that seems to bug people the most. When all we hear is how much the government is struggling with money and can’t pay for things like schools, and healthcare, and welfare, why do some people – and generally, the richest people – get away with ?

But not everyone agrees with this argument. Diego Zuluaga, an economist from the Institute of Economic Affairs (IEA), thinks it’s a pretty simplistic view of how things work. A lot of the tax that’s being avoided is what’s called ‘double taxation’ – which happens when you set up a business abroad, but also have to pay tax at home.

Plus, he says, if we didn’t have the legal loopholes that allow people to avoid paying tax at home, a lot of them wouldn’t bother investing, because it wouldn’t be profitable enough – which means it wouldn’t just be governments losing out, it’d be everyone benefiting from the business.

In other words, avoiding tax incentivises people to do stuff they wouldn’t necessarily do: buy something, invest in something, start a business. If they don’t do those things, they don’t owe the tax in the first place, and the government can’t lose something it never had.

It just doesn't feel fair to most of us

For some people, this isn’t just a story about tax laws. It’s a story that makes a much wider point about how unequal things are. A report published days after the Paradise Papers found that the richest 1 per cent of people own more than half the world’s wealth.

Katy Chakrabotti, the UK’s head of advocacy at Oxfam, said, “The recent Paradise Papers revelations laid bare one of the main drivers of – tax-dodging by rich individuals and multinationals. Governments should act to tackle extreme inequality that is undermining economies around the world, dividing societies and making it harder than ever for the poorest to improve their lives.”

In other words, while the rest of us struggle to do basic stuff like pay rent and buy food, the fact that there are people in the world that are rich enough to spend money on private jets and shopping malls in Lithuania and make even more money in the process is more than just annoying and unfair – according to Katy, it’s making things worse.

Zuluaga, from the more Institute of Economic Affairs, disagrees (funnily enough). He says that if we're talking about inequality, what we should talk about is low wages: “It’s one of the big factors in increasing the cost of living - their disposable income is successively being eroded. We should be focusing on the fact that people’s incomes aren’t going up.” And the thing that makes wages go up, Zuluaga argues, is business and investment. The way to encourage business and investment, is lower taxes.

Do you know where your pension was last night?

The thing is, it’s not like those of who aren't part of the 1 per cent aren't remotely linked to tax havens. In fact, there’s so much secrecy and confusion surrounding the amount of money stored around the world, and who’s it actually is, that it’s pretty likely that you, or your mum, or your boss could have money offshore without even knowing it.

Pensions are a pretty good example: when you or your employer pays money into your pension, it gets invested into a fund. Pension funds will then be invested elsewhere, to try and increase the amount of money in it. Sometimes that elsewhere might be “offshore”.

Caroline Escott, who works for the Pension and Lifetime Savings Association (which represents pension funds), said that pension funds are trying to find new ways of making money in “the current difficult financial and low-interest rate environment”.

When pension funds invest in low-tax areas, like tax havens, it’s normally for a variety of (pretty innocent) reasons, Escott says – like letting people from lots of different places invest in the fund easily, for example.

“One point to note is that while pension funds do invest overseas, they do not seek to ‘hide’ these assets.”

In other words, she says, so long as it’s all above board, and everyone knows what’s going on, low tax jurisdictions could have benefits for us all.

How much tax avoidance is too much tax avoidance?

And what about the fact that we’re being constantly offered tax breaks as a way to incentivise us to do things? Take saving money. If you do what the government tells you to do, and get an ISA, does that mean you’re also avoiding tax?

Jon Date, an advocacy advisor at Action Aid, which campaigns heavily against tax avoidance, thinks it’s not.

“It’s reducing the amount of tax you owe, but it’s a deliberate policy by the government to incentivise people to save.

“There isn’t a clear line between right and wrong in this stuff. I think one of the most important principles is that you’re using laws in the way that they’re intended to be used.”

The difference between when tax avoidance is okay, and when it isn’t, Date argues, is whether people are sticking to the "spirit" of the law. So yes, saving money on your ISA is okay. Getting an accountant to make sure you’re not paying too much money is okay.

“The problem comes when people or companies try and use laws in a way that wasn’t the way they were intended. So if they’re shifting money around artificially to reduce the tax they pay, they’re using loopholes for a reason other than the reason they were set up by governments, that’s when it becomes problematic.”

The answer, he says, is transparency. It needs to be easier to keep a closer eye on what companies are registered where, and to whom, on who exactly is buying shopping malls in Lithuania, and how much tax they’re actually paying.